Blog

Comparing apples with pears? Commentary on AidData’s report on China’s international development finance

In September this year, a new global database of China’s overseas spending was released by the research organisation AidData. This dataset consists of over 13,000 Chinese projects in 165 developing countries. It is the most wide-ranging and detailed data available on China’s overseas development finance so far, and offers insights into the way China’s aid and lending are targeted, implemented and delivered. A research paper titled ‘Banking on the Belt and Road’ was published with the dataset, summarising some key findings.

As the world’s second largest economy, China’s role in international development has become a hot topic both within and outside China in the last two decades. However, the lack of an official dataset on China’s development finance has made it hard to understand for both domestic and international communities, thus leaving space for international research institutions to fill the gap. Undoubtedly, AidData’s dataset will provide important references for the international community to understand China’s role in international development finance.

Comparability to OECD donors

One of the key features of this data is the way in which it aims to make Chinese development spending directly comparable with development finance data from traditional donors, such as the EU and its member states. The dataset covers the period from 2002 to 2021, although it only covers projects that were started up to and including 2017. In detailed project-by-project entries, the research team have aimed to define all projects using the criteria and definitions used by OECD Development Assistance Committee (DAC) members. This covers the inclusion of 3-digit OECD sector codes, implementing and funding agencies, geo-location coordinates where possible, and a categorisation of finance as either equivalent to Official Development Assistance (ODA) or Other Official Flows (OOF).

AidData released a similar database in 2017, covering China’s activities in developing countries from 2002 to 2014. However, the methodology used for data collection has significantly evolved in this round. The data released in 2017 was heavily reliant on potentially inaccurate media sources; in this update, the approach has been vastly improved, as the vast majority of data comes from official sources These include grant and loan agreements published by partner governments, data from aid and debt management systems, annual reports from Chinese banks, and official Chinese embassy and ministry websites. These methodological adjustments make the data both more reliable and more wide-ranging compared with the previous release, although there is of course no guarantee it provides a fully comprehensive picture.

How to define official sector transactions?

The headline figures in the research paper are striking. According the AidData report, China has spent around $80 billion annually since 2009, outspending all G7 countries individually and EU DAC members combined over the period 2013-2017 (since the Belt and Road Initiative (BRI) was launched). In order to improve data comparability with OECD countries, AidData used the OECD DAC’s definitions of Official Development Assistance (ODA) and Other Official Flows (OOF). However, what is included in the category of ‘Other Official Flows’ (OOF) is debatable. This form of finance is defined by the OECD as ‘official sector transactions that do not meet ODA criteria’, with examples such as non-concessional loans (more than 25 per cent grant element) or export facilitating finance. In the AidData dataset, the OOF category includes finance from China’s large policy banks, China Development Bank and the Export Import Bank of China (EXIM); state-owned commercial banks, such as ICBC and China Construction Bank; as well as spending by State Owned Enterprises (SOEs), such as Sinohydro and China Road and Bridge Corporation. This leads to the inclusion of projects such as a €2 billion Bank of China loan to Russia for a Siberian gas pipeline, and an ICBC ship leasing contract in Brazil, which are not directly comparable to OOF from DAC members. We would argue that financial flows from these Chinese banks, although often significant in terms of development impact, should not be considered as official development finance. Although China’s commercial banks certainly have more state direction than comparable Western institutions, they operate largely as commercial entities, driven by profit motives and the need to generate return on their investments. This is also the case when it comes to Chinese companies: loans from SOEs to entities in partner countries are primarily operated on a commercial basis, with little to no official involvement.

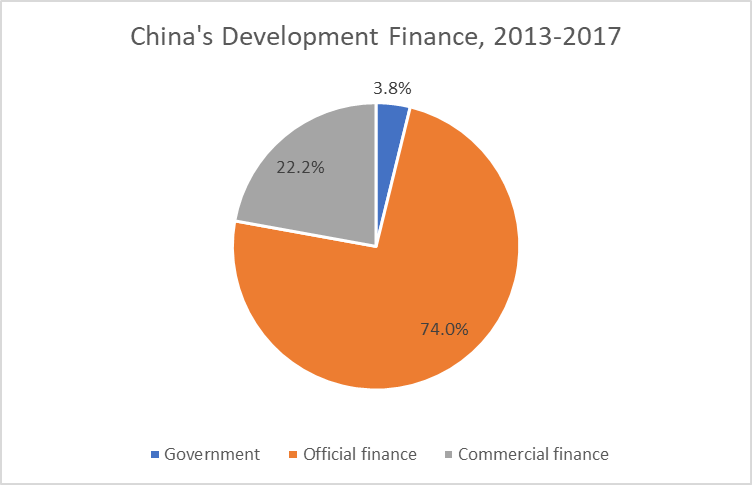

Using this maximalist definition of OOF to compare China’s development finance with that from traditional development actors obscures the real picture and over-exaggerates China’s levels of development finance. Our initial calculations based on AidData’s dataset show that in actual fact, in the post-BRI period, approximately 22.2 per cent of Chinese finance to developing countries has come from commercial sources (SOEs and state-owned commercial banks), 74 per cent from official financial institutions (policy banks, including co-financed projects), and only 3.8 per cent directly from government agencies (Figure 1). Applying the DAC definition of OOF as ‘official sector transactions’ (as above), we would categorise policy bank lending as fitting into this category, whereas China’s commercial lending is more comparable to financial flows from European private banks.

Figure 1: China’s development finance since BRI launch

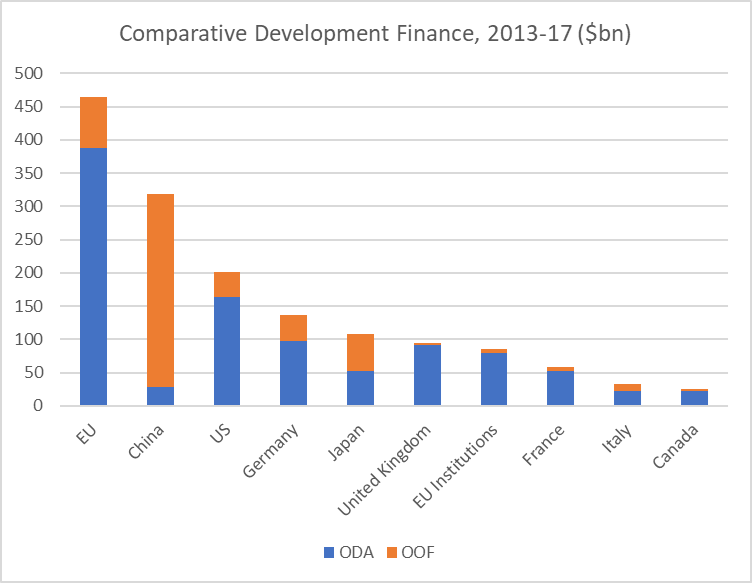

Based on these categorisations of China’s development finance, rather than AidData’s wider interpretation, we find that China’s role post-BRI is certainly significant but not as outsized as the headline claims. China’s overall official finance (ODA and OOF) in this period amounts to $319 billion, making it the second largest provider of development finance globally after the EU (Figure 2).

Figure 2: Comparative development finance: China, EU and G7

However, the composition of China’s development finance is markedly different from traditional donors. Whilst some of the loans from Chinese policy banks are concessional in nature, and therefore qualify as ODA under the OECD ‘grant equivalent’ calculation system, the majority of China’s official sector lending fits better into the OOF category. None of the other major providers of development finance (with the slight exception of Japan) follow a similar pattern, with much more concentration on ODA spending. If we focus purely on ODA-like spending, China remains a significant actor but not one of the world’s biggest donors. In comparative terms, China’s $29 billion in ODA spending over this five-year period was higher than Italy, and lower than France.

Moves towards more transparency?

In the absence of detailed official Chinese data on their development finance, AidData’s work is hugely welcome and makes a major contribution to filling a gap in our collective knowledge. However, we would urge users of the data to carefully consider issues of categorisation and interpretation, particularly when comparing Chinese finance with that of traditional donors.

We also hope that the efforts of international research organisations like AidData will push China to accelerate its own moves towards transparency and the construction of a comprehensive dataset on development finance. There are some positive signals that China is starting to move in this direction. The White Paper on China’s international development cooperation released in January this year stated that ‘drawing experience from international practices, China will work to revise and improve the statistical indicator system of foreign aid, and develop a modern statistical information system for foreign assistance.’ There is an insight into how this might happen in the recently released revised rules on China’s foreign aid management, which specifically mandates China International Development Cooperation Agency (CIDCA) to fulfill the task of data collection. In addition, an official think-tank, the Chinese Academy of International Trade and Economic Cooperation (CAITEC), under the Ministry of Commerce (MOFCOM) published a detailed report ‘China’s Trade and Investment Cooperation under the Belt and Road Initiative’. We hope that these moves are the start of increased systematic transparency from China, to provide a comprehensive picture about China’s development cooperation with partner countries around the world.

This blog was authored by Ellen Kelly (Development Counsellor, EU Delegation to China) and Chuanhong Zhang (Associate Professor, College of Humanities and Development, China Agricultural University).